The Commodities Bubble and Ethanol

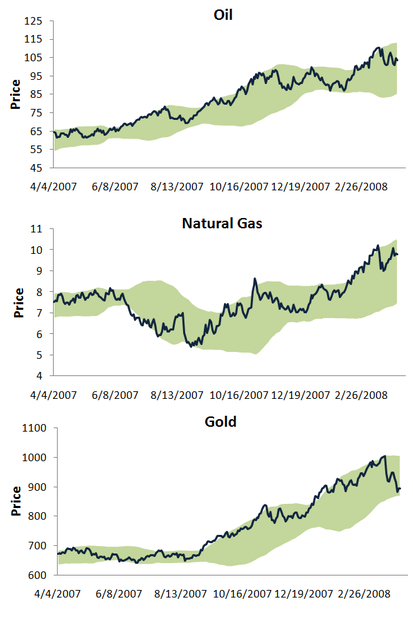

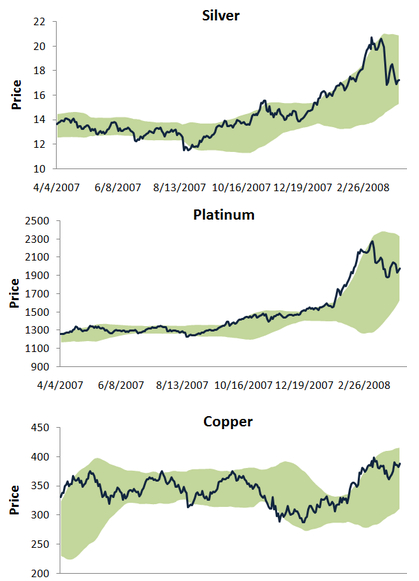

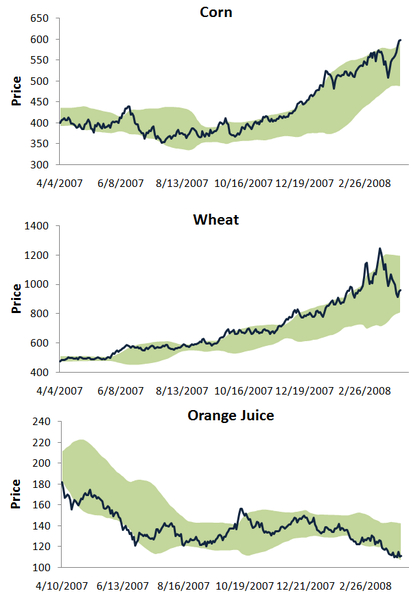

This post at Dean’s World reflects the common view that ethanol is driving up the price of corn. However from what I’ve read all commodities are in a bubble due to the declining dollar, the threat of inflation, and the impact the subprime crisis has had on business earnings. I suppose the money has to go somewhere, and right now that place seems to be commodities. Here are some comparative charts taken from Seeking Alpha:

Note that with the exception of orange juice, all the commodities are moving in tandem, spiking in February (and doing the same this month – but the charts don’t go that far).

If ethanol demand is driving the price of corn, wouldn’t the price be rising faster than the other commodities? While ethanol is no doubt partly to blame for the rising price, how much ethanol do we produce from wheat or platinum?

I’m not an economist, but I think the commodities bubble can be blamed more than biofuels. Unlike the housing bubble or the internet bubble, the commodities bubble is really quite painful, so the sooner it bursts the better – at least for my pocketbook.

Francis Schutte:

Has it occured that the price evolution of commodities cannot really be compared to the price evolution of Real Estate, Stocks and Bonds?

6 August 2008, 8:12 amCommodities are in limited supply. Hence if their price goes up as the supply and stocks come down and the demand increases, one can hardly say we have a bubble!

Scott Kirwin:

Stocks, bonds and real estate all have limited supplies. Sure woodland can be turned into farms, and farms turned into suburbs; but then again, gold can be mined, oil extracted. Once those commodities are extracted, the supply of them is increased in the same way that real estate is “increased”.

6 August 2008, 7:39 pm