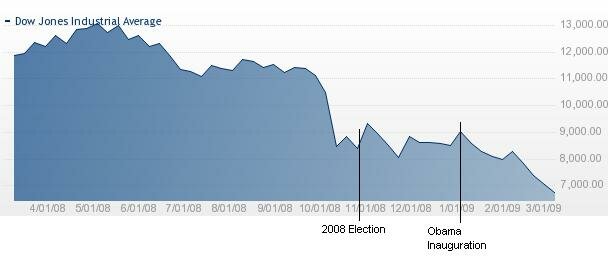

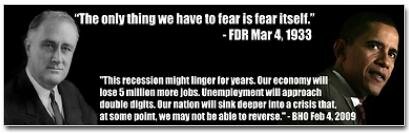

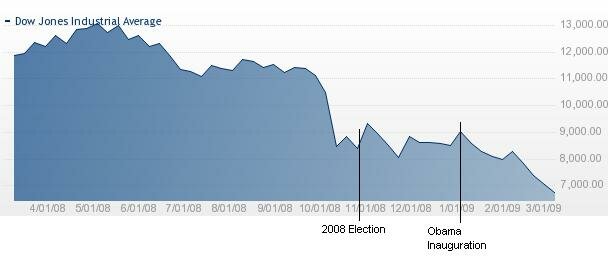

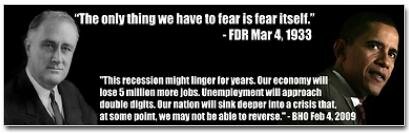

For the past year or so Barack Obama and the Democrats have talked down the economy. At first it was to beat down then President Bush to boost the Democrats’ chances in the November 2008 election. After the election it was to decrease expectations for the new president and his administration. Following his inauguration the President and his Democratic allies used fear to promote their economic stimulus plan. Mike Volpe, aka The Provocateur, noted that in one speech alone Obama used the term “crisis” 20 times and has called the Administration’s statements a “never ending stream of bad news.” The Market has responded accordingly, falling 15% or 1,186 since the close of the Dow on Inauguration Day (a day which saw a 332 point loss).

MarketPsych is a firm that has shown statistically that fear moves markets. The graphic below shows that when the market is rising, fear is subsides. The relationship reverses when the market declines.

Market Fear Index shows a 10-day exponential moving average of the percentage of “Fear” words in the U.S. financial news (left axis) displayed over a candlestick chart of the Nasdaq 100 (right axis). Source: MarketPysch

The problem with fear is that it’s much easier to scare someone than it is to assure him. According to Andrew W. Lo, a professor at the Massachusetts Institute of Technology, “Fear is a much stronger motivational force. The loss of $1,000 has a much bigger impact than the gain of a $1,000.”

In addition to the fearmongering, Obama and the Democrats have enacted policies that are exacerbating economic problems. James G. Gimpel, professor of political science at the University of Maryland – College Park, noted on Politico that the customary government response during a recession is to implement austerity measures and spending cuts. This assures investors and consumers that they will have more of their own money to spend in the future. However Obama and his Democratic allies have done the exact opposite – implementing spending and tax increases that convince investors and consumers that they will have less to spend in the short term than they do now. This kills an incentive for investors to bargain hunt in the depressed market, and encourages consumers to keep their wallets shut.

Worse in their zeal to “do something” to fix the economy, Obama and the Democrat controlled Congress are showing their growing impotence. Starting last autumn with the TARP legislation that was supposed to “end the crisis”, we’ve had further bailouts that were supposed to “end the crisis” followed by a stimulus package that was supposed to “end the crisis.” Instead of showing their mastery of the economy investors are consumers are presented with a Chinese firedrill whereby Commerce Secretary Geithner, the President and the Democratic Congress are pereceived as running around cluelessly throwing cash into the growing flames of the American economy.

The problem is that the money is feeding the very fire it was supposed to put out – in the sense that people understand instinctively that the money has to come from the American Taxpayer – and that they are “American Taxpayer”. They hunker down economically, and the economy suffers.

The Obama Administration is making things worse by succombing to their anti-capitalist ideology as the Wall Street Journal notes today:

... it’s become clear that Mr. Obama’s policies are slowing, if not stopping, what would otherwise be the normal process of economic recovery. From punishing business to squandering scarce national public resources, Team Obama is creating more uncertainty and less confidence—and thus a longer period of recession or subpar growth.

On his inauguration day in 1933 Franklin D. Roosevelt recognized how fear impacted the economy. Unfortunately he didn’t understand the economics behind that fear which lead to many of his policies prolonging the Great Depression. By instilling fear and enacting policies that damage the economy Obama and the Democrats prove that they understand neither psychology nor economics.